Ten dollars in your pocket is not the same as ten dollars in the bank and neither are the same as a ten dollar credit on your electric bill or the ten dollars your friend owes you. Ripple is simply a manifestation of this insight.

I spent a couple of hours at the Startupbootcamp Fintechathon last weekend. I was there to share ideas on what types of finance problem are a good fit for block chain solutions – and which ones might be best solved using other techniques.

When I arrived, the audience were deep in videoconference with Ryan Terribilini of Ripple Labs. I thought he did a great job of answering their questions about Ripple and I decided it was time I finally tried to get my head around it.

The conclusion I have come to is that Ripple is built on a really deep insight:

Not all dollar, euro and sterling liabilities are the same.

And Ripple is nothing more than a platform that makes this insight explicit.

Here’s how I finally wrapped my head around Ripple

I wrote a piece last year about how money moves around the banking system. I wrote:

Perhaps the most important thing we need to realise about bank deposits is that they are liabilities. When you pay money into a bank, you don’t really have a deposit… you have lent that money to the bank. They owe it to you. It becomes one of their liabilities. That’s why we say our accounts are in credit: we have extended credit to the bank. Similarly, if you are overdrawn and owe money to the bank, that becomes your liability and their asset.

I then explained how the payment system is really little more than a bunch of systems for transferring these obligations around. Where Ripple encourages us to think more deeply is about whose obligations they are.

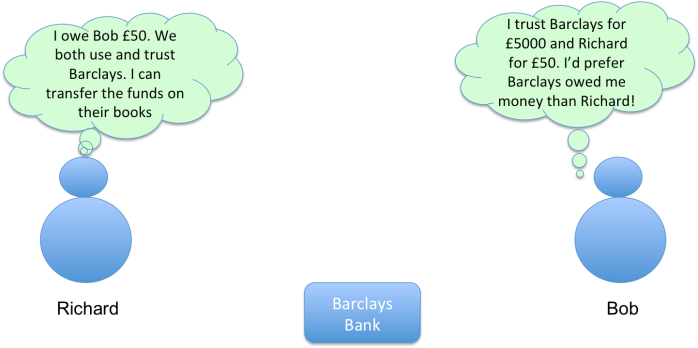

Imagine I owe my friend Bob £50 and that we are both customers of Barclays bank. When it’s time for me to pay him back, I instruct a “transfer” online. I tell the bank to reduce what they owe me by £50 and increase what they owe to Bob by £50. The bank remains flat… the only difference is to whom they owe the money.

This is the same story I told in my piece about the payments system.

Richard and Bob both trust Barclays as an issuer of pounds. So Richard can pay Bob by transferring the money inside Barclays

But think about just happened:

- Before the transfer, I owed £50 to Bob.

- After the transfer, the bank owes £50 to Bob.

Bob still doesn’t have the £50 in his hand… all that’s happened is that somebody else now owes him the money. But this is just fine for Bob…. He trusted me to owe him the money and he also trusts his bank to owe it to him.

Bob previously had a £50 “asset” issued by Richard. Now he has a £50 asset issued by Barclays. Richard’s debt to Bob is settled and Bob is happy.

OK – so that’s obvious, perhaps.

But notice how it only worked because Bob trusted both me and the bank.

And also notice that he doesn’t trust us in the same way. He’d probably be quite happy to have thousands of pounds in his bank account. I suspect he’d be very uncomfortable lending me more than £50.

Not all dollar, euro or sterling asset deposits are the same! It matters who issues them.

It is highly likely that Bob prefers to be owed money by his bank than by me. £50 owed by me is not the same as £50 owed by the bank.

And this is the Ripple insight.

This is a really powerful observation

Imagine now that the situation is a little more complicated. Bob and I are sitting in a café. I don’t have any cash and Bob can’t remember his account details. How am I going to pay him? A Barclays transfer isn’t going to work.

Out of the corner of my eye, I see that the café sells prepaid debit cards. Excellent! I use my own debit card to buy a £50 prepaid debit card and hand it to Bob. My debt is settled, right?

Not so fast….

What makes me think Bob would be happy to accept a prepaid debit card from an issuer he’s never heard of? Are they insured? What happens if they go bust before he can spend the cash?

£50 on a prepaid debit card is not the same as £50 in cash or a £50 IOU from a friend or £50 owed by Barclays bank. And it is Bob’s choice whether to trust that card.

It turns out that Bob doesn’t trust this card… So we have a problem. I don’t have his bank account details and he won’t accept a prepaid debit card. How am I going to pay him?

Conveniently for my story, it just so happens that my friend Carol is sitting at the table next to us. Bob doesn’t know Carol so I introduce them to each other.

It turns out that Carol is trying to buy some goods online and has forgotten to bring her credit card. The goods cost £50 and she just happens to have £50 in cash in her purse. (It really is a most amazing coincidence…)

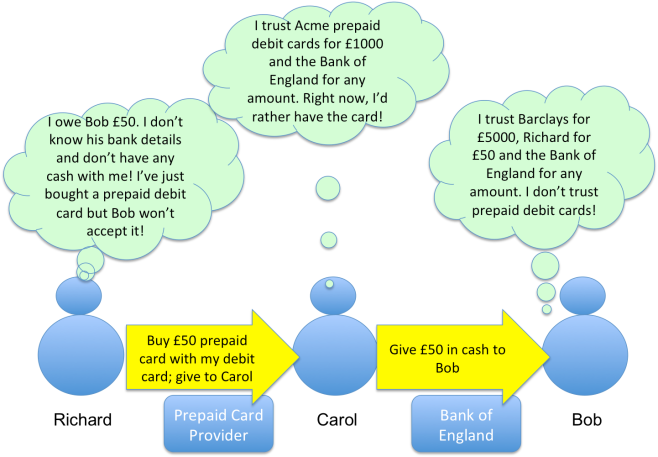

So the situation is something like the diagram below. We see that I have nothing that Bob will accept as payment but that Carol might be able to help us bridge the gap. (I’ve added some detail to show that each person might trust each issuer to different extents – it’s not a yes or no question)

How can Richard pay Bob when there are no issuers of pound sterling that Bob trusts that Richard is able to use?

Here’s what we could do: I could give Carol the prepaid debit card (she needs something she can use online and the £50 balance is well below the £1000 limit that she is willing to trust the card company for) and she can then give the £50 in cash to Bob. Bob is happy to take the cash: he also trusts the Bank of England, the issuer of the notes.

Great: Bob now has £50 issued by somebody he trusts. I’ve managed to pay Bob what I owe him by enlisting the help of a prepaid debit card provider and Carol… even though Bob didn’t trust the prepaid debit card and he doesn’t even know Carol.

Richard can pay Bob by “rippling” his transaction through multiple issuers and intermediaries, finding a route of trust that wouldn’t have been possible otherwise.

Yes, yes, I know…. It’s an utterly contrived example. But it makes the point: not all pounds, dollars and euros are the same. It all depends on the issuer: when we open a bank account in the UK, we’re saying we trust that bank to issue GBP liabilities to us. When we lend £50 to a friend, we’re saying we trust that friend to issue GBP IOUs. And we all trust different groups of issuers and to different extents.

So how does this relate to Ripple?

The answer is that Ripple is a general purpose ledger and payment network based on the key insight that when you try to pay somebody, it’s only going to work if they end up with an asset that was issued by an issuer they trust.

In our case, Bob trusted me, he trusted Barclays and he trusted the Bank of England. But he didn’t trust the prepaid debit provider and he doesn’t trust Carol – so a £50 balance issued by the prepaid debit card provider was never going to satisfy Bob.

But, because Carol and I both trusted the prepaid debit provider and both Carol and Bob trusted the Bank of England – and Carol actually had some notes issued by the Bank of England in her purse – I was able to settle my debt to Bob by routing it through the prepaid debit card provider and through Carol.

The lesson of all this is that if you’re going to build a system that represents real-world currency balances and make payments between them, you really need to think about who issues those balances.

And once you get this point, the point of Ripple becomes clear: it’s a way for one person to hold funds issued by issuers he or she trusts – and to pay anybody else by transforming those funds into balances issued by issuers that the recipient trusts.

Sure – there’s more to it than that…. But once you get the idea that any individual participant will only trust balances issued by certain issuers, the whole point and design of the network becomes clear.

But this isn’t really about Richard, Bob and Carol: think about the banks themselves and major corporations

The example in this post feels contrived, because it is. But imagine you’re a major bank. You have precisely this problem: you have correspondent banking arrangements around the world. You have separately capitalised and regulated subsidiaries around the world. And you need to make payments to people and firms all over the world on behalf of yourself and on behalf of your customers.

You need to keep track of balances issued by hundreds of legal entities around the world and need to instruct transfers and exchanges thousands of times per day.

Today, you do this through correspondent banking arrangements, the SWIFT network and multiple other intermediaries and communication platforms.

If I understand the vision correctly, Ripple sees itself as a universal, distributed ledger for simplifying and rationalising this complicated landscape.

Will it work? Will the banks and major firms adopt it? Who knows. But the underlying insight is deep and it feels like they’ve figured out something that is important.

Postscript: What about Bitcoin?

It amuses me when I see Bitcoin and Ripple discussed in the same context because, for me, they’re completely different. The core of Bitcoin is all about building a trust-free decentralized transaction ledger for tracking the ownership and transfer of scarce tokens – Bitcoins. And the whole point of Bitcoins is that they are counterparty-risk-free assets: my Bitcoin is not somebody else’s liability.

By contrast, Ripple is all about dealing with assets that are somebody else’s liability. So the focus in Ripple is on representing liabilities issued by identifiable issuers and enabling them to be transferred between individuals on a network.

They share some similarities but they’re not the same thing at all.

I sometimes describe Ripple as a platform for issuing, holding, transferring, and exchanging arbitrary assets.

@David – thanks for the comment. I must admit the piece I don’t yet fully understand is the “holding” piece… with whom do I need to have contractual relationships for this to work? e.g. Imagine I am a customer of Bitstamp and they issue a €100 balance on Ripple to me and I then send €50 of it to somebody else (who presumably has indicated that they trust Bitstamp for Euros). The Ripple system records that they have a claim of €50 against Bitstamp. What is the nature of their contractual claim against Bitstamp? It’s possible to extend trust to an entity without their permission (or knowledge?), right? So what happens if that person had simply trusted Bitstamp but never opened an account with them? Why should Bitstamp feel obligated to redeem the balance?

Gendal asks a good question and this is the crux of whether there is a shaky legal foundation for Ripple.

My own view is that Bitstamp is kind of like a central bank issuing paper notes. Anyone can use them but only certain people (i.e., banks) have the right to send in those paper obligations and get them for something else (digital obligations!!!). Everyone else just circulates the paper amongst each other and hope they are worth something at the end of the day.

So if you are not a direct customer of Bitstamp you just pass those Bitstamp IOUs around on Ripple as long as others are willing to accept them. And some Ripple users who have an account with Bitstamp can accept them and convert them into euros to send to their bank account.

I’ll leave it to the lawyers to complicate what is otherwise a pretty straightforward operating model.

@gendal this is such a helpful, concise description of Ripple. Great analysis

Great explanation. Question: isn’t Ripple using blockchain technology to achieve the “ledger”?

@gendal asks: Why should Bitstamp feel obligated to redeem the balance?

a) if the bearer does not have an account (and contractual agreement) with Bitstamp, there is no obligation to redeem the balance; on the contrary, Bitstamp would probably be shut down for *redeeming* the balance to someone who didn’t submit KYC / AML information. Nonetheless, anyone with a trustline to Bitstamp can hold their balances.

b) if the bearer does have an account, then Bitstamp is likely not only obligated by contract, but will also continue to redeem as long as possible to maintain good standing as a depository institution.

@Chuck Phipps asks : isn’t Ripple using blockchain technology to achieve the “ledger”?

No, they are using their own consensus method simply called “consensus” which creates a new “ledger” in the “ledger chain” approximately every 5 seconds.

-David

Richard, I’m curious to hear your thoughts on a couple issues people have pointed out with Ripple:

(1) If I trust you for $50 and I trust Barclays for $1000, then the Ripple system will be free to swap $50 worth of IOUs that I am owed from Barclays for $50 worth of IOUs that you owe. It will swap then one-to-one, with no compensation for me. You correctly point out that I trust you and Barclay’s differently, but Ripple does not model this in a reasonable way. It can’t be modeled simply by putting a dollar limit on how much debt I’ll accept from each source. I am NOT indifferent to holding owning a $50 IOU from you and a $950 IOU from Barclay’s vs. owning a $1000 IOU from Barclay’s only. Ripple treats trust as binary until we pass that $50 limit. You could say that Ripple models trust as a step function — I trust you and Barclay’s equally up to $50, then completely differently beyond that. I don’t see how this can work. Do you?

(2) As far as I know, there are no repayment terms associated with IOUs in Ripple. Suppose I lend you $50 and you promise to pay me back in a month. Let’s say that some other guy who I’m doing business with also trusts you, and Ripple ends up giving him some of the IOUs that I originally got from you. But let’s say that guy needs to redeem them in 2 weeks. I’ve never seen a description of how Ripple handles this.

@Chuck – no. Ripple is somewhat distributed but doesn’t use a blockchain (at least not in the sense understood by those who know Bitcoin). Rather than achieve consensus a through proof-of-work-secured blockchain, it has a concept of “validators” which collaborate with each other to agree on a set of transactions — and users decide which set of validators to trust. (At least I think that’s how it works!)

@Tal 1 – good point. My understanding is that if you tick the “allow rippling” box then Ripple is indeed free to move balances between issuers that you trust and that this is how it allows people to pay people with whom they don’t share a common trusted issuer. If I understand your question, you’re implying that those who provide this service should be compensated for it, right? (e.g. if I allow my balances to be switched between two issuers at will by other parties then am I not at risk of adverse selection? In the event that one issuer becomes unsound, people with better information will use me to reduce their exposure… I guess the lesson is that people need to realise precisely what they are signing up to when they extend a trust line!)

@Tal 2 – that’s also my understanding… it’s a ledger of obligations… the conditions under which those obligations have been entered in to are out of scope. I guess one could imagine an evolution whereby issuers create multiple gateways… a “Demand gateway”… a “Deposit gateway”… a “one year gateway”… etc…? And your ability to convert balances on the gateway will differ according to the Ts&Cs associated with that gateway?

@gendal – Think you forgot to mention the role of XRP here. There indeed is a discusion going between Bitcoin-Ripple (lovers, users, holders..) and in some way that fight may have sense. Under the hood of Ripple, Bitcoin is an IOU as well just like any other asset kept by some other (service). XRP on the contrary is the internal currency and therefor, within Ripple the only easy to use store of value without any counterpart, cold or hot. I think the discussion may have more sense then Ripple Labs is always saying. I’m not saying that Ripple makes the future more unsure, but I can understand the (Ripple) fears of those having (heavy) invested in Bitcoins.

@gendal – Think you forgot to mention the role of XRP here. There indeed is a discusion going between Bitcoin-Ripple (lovers, users, holders..) and in some way that fight may have sense. Under the hood of Ripple, Bitcoin is an IOU as well just like any other asset kept by some other (service). XRP on the contrary is the internal currency and therefor, within Ripple the only easy to use store of value without any counterpart, cold or hot. I think the discussion may have more sense then Ripple Labs is always saying. I’m not saying that Ripple makes the future more unsure, but I can understand the (Ripple) fears of those having (heavy) invested in Bitcoins.

Hi Marc – agreed. It’s an interesting question, really. You don’t actually need to introduce the concept of XRP to explain the platform at a fundamental level… yes it’s absolutely critical to anti-spam and building a business for Ripple Labs et al!

Great article. Thanks for sharing your insights.

Good Article ! I can sense an opportunity by bitstamp to exchange IOUs with another Fiat currency at opportune time and make some real(Fiat) money for themselves.

Very nice article. Thank you for posting it! You could me a post comparing Corda with Ripple. It would be very helpful.